Managing costs is a crucial aspect of running a small to medium-sized business. In this comprehensive guide, we will delve into effective strategies for reducing overhead expenses, including the advantages of selecting a bank provider for Merchant Services, to help your small business not only survive - but thrive!

1. Squash Your Hidden Costs

Business costs can often go unnoticed, but they can quickly accumulate and eat into your profits. These hidden costs may include the increasing prices of insurance policies, subscriptions that you don't use, permits, and industry memberships that offer no real benefits. To identify these costs, take the time to review your bank account and track your expenses. This will help you identify areas where you can cut back and save money. It's also important to carefully examine supplier invoices to ensure there is no overcharging, double billing, or missed discounts. By being vigilant with your expenses, you can hold onto your hard-earned cash and make smarter financial decisions.

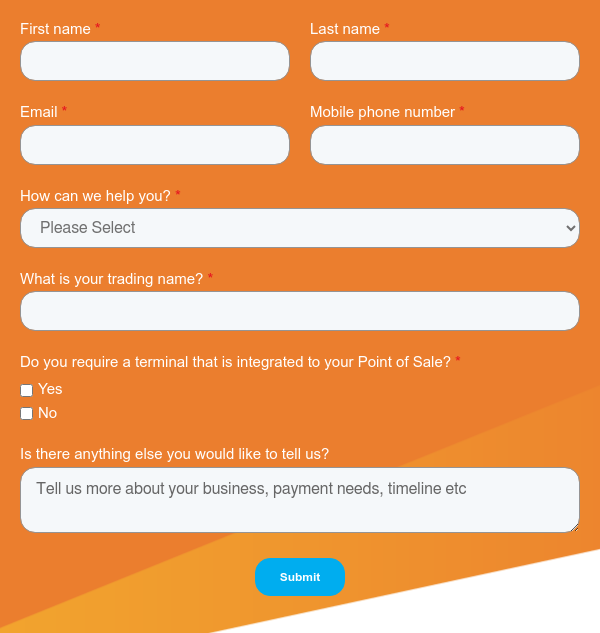

2. Pay Less for Payments

Next to wages and rent, businesses often cite payments as being one of their biggest expenses, specifically Merchant Service Fees which are fees typically charged as a percentage of the transaction amount for credit and contactless transactions. Opting for your bank as your Merchant Services provider can be a game-changer. Banks offer transparent pricing, eliminating hidden fees. They provide clarity on cancellation fees, monthly fees, and international card rates. Unlike non-bank providers, banks don't charge GST on Merchant Service Fees. They also offer the advantage of processing settlements seven days a week, ensuring optimal cash flow. You can offset your Merchant Service Fees with automatic surcharging solutions on your EFTPOS terminal.

3. Save on Power

One of the easiest ways to start cutting overhead costs is by reducing energy expenses. There are simple steps you can take to lower your energy consumption and subsequently reduce bills. Ensure your premises are well-insulated to retain heat during winter and cool air during summer, reducing the reliance on heating and cooling systems. Switching to energy-efficient lighting, such as LED bulbs, can significantly reduce electricity usage and lead to substantial savings on your energy bill.

4. Reassess Rent

Consider whether leasing an office space or a physical shopfront is truly the most cost-effective option for your small business. By eliminating the need for physical space, you can significantly reduce expenses such as rent, utilities, and maintenance and free up valuable financial resources that can be redirected towards other areas of your business. Explore shared office spaces or co-working arrangements, as well as virtual offices and e-commerce platforms, instead of traditional brick-and-mortar locations. Launching an online store is a budget-friendly option that requires minimal overhead costs. An online store allows you to benefit from round-the-clock sales, and detailed product descriptions, customer reviews, and helpful content like videos can lead to more purchases and increased customer engagement.

5. Opt for Equipment Rental

Consider renting equipment instead of making significant upfront investments when equipping your small business. Renting equipment provides access to necessary tools without the ownership burden and associated costs of maintenance and upgrades. It offers flexibility and scalability for your business, especially for items with a limited lifespan. In rapidly advancing industries, technology can quickly become outdated, making it impractical to invest in expensive equipment that may become obsolete in a short time. By renting, you can stay up-to-date with the latest advancements without the financial burden of purchasing new equipment every time a technological breakthrough occurs. Renting equipment often includes maintenance, repair services, and insurance coverage, saving you time and resources, and protecting you from unexpected expenses. When considering equipment rental, carefully evaluate your needs, choose reputable providers, and compare terms and prices.

Take Our Quiz: Should You Purchase Or Lease Your EFTPOS Terminal?

6. Outsource Strategically

Outsourcing can be a game-changer for small businesses looking to streamline their operations and cut costs. By entrusting non-core functions to specialised service providers, you can not only save on operational expenses but also free up valuable time and resources to focus on core business activities. When outsourcing, carefully evaluate which functions are best suited for external support, such as accounting, human resources, IT support, or marketing. By allowing experts to handle these areas, you can benefit from their specialised knowledge and experience, resulting in improved efficiency and cost savings. Before making any decisions, assess your business needs, budget, and long-term goals. Consider the risks and benefits associated with outsourcing, and make sure to choose reputable service providers with a proven track record of delivering quality results.

Check Out Our Blog: Free & Low-Cost Software & Tools For NZ Businesses 2024

7. Negotiate Contracts Wisely

Regularly re-evaluate your supplier contracts to find opportunities for cost-cutting. Building strong and collaborative relationships with suppliers increases the likelihood of securing discounts and favourable terms. Use these relationships to negotiate better prices, lower minimum order quantities, or even exclusive deals. Openly communicate your business needs and goals to suppliers to foster collaboration, innovation, and cost-saving suggestions. When negotiating, adopt a win-win mindset that takes into consideration the perspectives and challenges of your suppliers. This approach builds a mutually beneficial partnership that drives cost savings and supports growth objectives for both parties.

Check Out Our Blog: Questions to Ask your EFTPOS Provider

.jpg)

Comments