One of the key considerations for businesses trading under all COVID-19 Alert Levels is how to take payment while limiting physical contact with customers. In this guide, we walk you through different contactless payment options to suit different ways of trading.

Editors note: Blog content updated on 23 August 2021

Below are some scenarios that might apply to your business. Click the links to see a description of the contactless payment method that applies, how it works and how to get it set up.

- I want to take payments online, on my website

- I want a virtual terminal to take payments over the phone anywhere

- I want a payment solution so I can take payment at my customer's table

- I want to avoid customers queuing/congregating in my business

- I want to use my existing terminal to take payment from my customers over the phone

- I want a payment solution installed at my business that limits physical contact with my customers

- I want mobile payments for curbside or home delivery

- I want to enable contactless ‘PayWave’ payments on my EFTPOS terminal/s

I want to take payments online

Did you know you can sell essential good online with contactless delivery even at COVID-19 Alert Level 4? See MBIE's official guidelines on what is "essential" and what can be sold online here.

If you’re looking for an easy, reliable way to start selling online, platforms like WordPress and Shopify make it easy to get your online sales up and running with no drama. We can provide online payment gateway services via the Verifone WooCommerce plugin for WordPress websites.

How do I set this up?

The Verifone WooCommerce plugin will soon be available for all businesses in New Zealand, but in the meantime, an exclusive release for merchants that bank with ANZ Bank New Zealand is available now. Benefits include affordable, transparent pricing with no transaction volume caps, next-day settlement and visibility of all of your online and in-store transactions via the Verifone Merchant Portal. Learn more here.

If you don’t already have a website, check out Storbie. The team at Storbie can help you get up and running with an online shop fast.

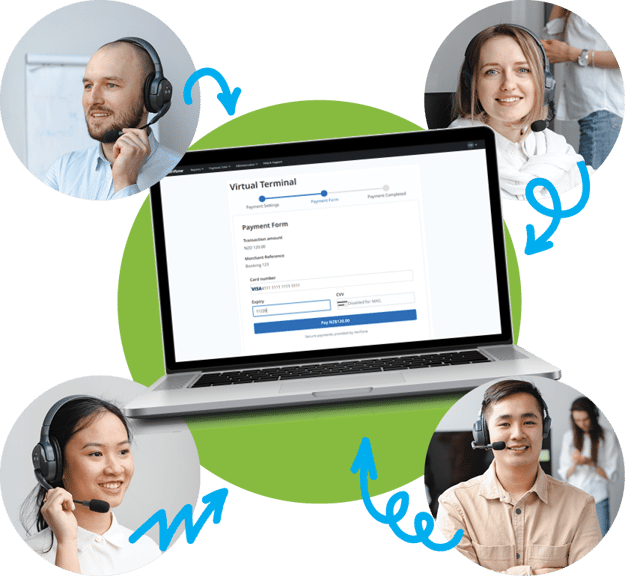

I want a Virtual Terminal to take payments over the phone

Did you know you can sell essential good online with contactless delivery even at COVID-19 Alert Level 4? See MBIE's official guidelines on what is "essential" and what can be sold online here.

You can take payment from your customers remotely with the Verifone Virtual Terminal. Customer card details are entered into a secure online payment form on the Verifone Merchant Portal to process payments. The Virtual Terminal gives your sales and support reps an easier and more secure way to process card payments. All you need is a device that can access the internet, such as a laptop or tablet. Plus, you can grant as many users access to your Virtual Terminal facility as you need! There are no user license caps or additional fees for additional users.

Using the Virtual Terminal allows you to take payment from customers in a completely contactless way, keeping both your customers and team safe.

How do I set this up?

Virtual Terminal will soon be available for all businesses in New Zealand, but in the meantime, an exclusive release for merchants that bank with ANZ Bank New Zealand is available now. Learn more and apply here.

If you would prefer to set up a terminal with MOTO to take remote payments, rather than Virtual Terminal, we can arrange a new terminal, with MOTO payments ready-to-go, to be delivered by courier to any residential address in New Zealand.

Please note there are fees associated with processing MOTO transactions on a terminal or via the Virtual Terminal, you will need to confirm the applicable rates with your bank.

I want a payment solution so I can take payment at my customer's table

Taking payment at the table will help you meet single server requirements and maintain physical distancing by reducing queueing at your point of sale and keeping diners and takeaway customers separate. A portable terminal can connect to your business's internet and transact anywhere in your business, including tableside. You can even connect a portable EFTPOS terminal to your Point of Sale (POS), so all your sales still go through your POS system. Our EFTPOS terminals are all contactless 'PayWave' capable, including our POS integrated mobile terminals.

How do I set this up?

Get in touch with us here if you would like more information about mobile EFTPOS terminals. Our team of EFTPOS experts can answer all of your questions and take you through any connectivity and install requirements.

If you're interested in connecting your POS with a mobile terminal, a good place to start is to check if your POS is already accredited for integration with our EFTPOS solutions, find out here. Our mobile integrated solutions are also compatible with contactless ‘paywave’ payments.

I want to avoid customers queuing/congregating in my business

If your business encourages customers to congregate closely together, while they are waiting for their order or waiting to pay, you risk breaching physical distancing guidelines. Fortunately, there are solutions you can put in place to avoid queues at your point of payment, for example:

- Speed up payment by enabling contactless 'PayWave' payments - Keep your queues moving by eliminating the need for your customers to swipe their card or enter their PIN and significantly reducing transactions declined due to incorrect PIN entry.

- Take payment at the table - Keep diners and takeaway customers separate and meet single server requirements at Alert Level 2 by taking payment at the table with a mobile terminal.

- Set up an additional queue - Create another point of payment in your business to spread your customers out across your premises.

How do I set this up?

Get in touch with us here if you would like more information about mobile EFTPOS terminals or setting up a new point of payment. Our team of EFTPOS experts can answer any of your questions and take you through any connectivity and install requirements.

If you want to enable contactless payments on your EFTPOS device/s, contact the bank that provides your merchant facility. See how to contact your bank here.

I want to use my existing terminal to take payment from my customers over the phone

A MOTO (mail-order/telephone-order) solution allows you to take payment over the phone by manually entering your customers’ credit or scheme debit card number into your terminal. A ‘scheme debit card’ is a card issued by a credit card scheme, like Visa or Mastercard. If the card has a Visa, Mastercard or other credit card scheme logo on it, then it can be used for a MOTO transaction. Using MOTO allows you to take payment from customers in a completely contactless way, with no face-to-face contact required.

Both our credit card pre-authorisation and credit card surcharging solutions are compatible with MOTO payments.

- Learn more about MOTO here.

- See our guide to taking payments using MOTO here for step-by-step instructions.

- See how to refund MOTO transactions here.

How do I set this up?

You can enable MOTO on your existing terminal. This means that if you can access your existing terminal, you won’t need a new device. Find out what to do if you can’t access your EFTPOS terminal here.

You will need to apply to the bank that provides your merchant facility to accept card-not-present (MOTO) transactions. If your bank approves your business to take MOTO payments, they will advise us to enable the solution on your device/s. There are fees associated with processing MOTO transactions, you will need to confirm the applicable rates with your bank.

I want a payment solution installed at my business that limits physical contact with my customers

The best solution for reducing physical contact with customers while taking payment in-person is a Point of Sale integrated terminal connected to your business’s internet.

The best solution for reducing physical contact with customers while taking payment in-person is a Point of Sale integrated terminal connected to your business’s internet.

When your EFTPOS terminal is integrated with your Point of Sale (POS), all merchant interactions throughout the payment process are made on the POS, so you don’t need to hand an EFTPOS terminal back-and-forth between yourself and the customer. Integrating your POS with a mobile EFTPOS terminal also allows you to keep the device away from the point of sale. This means you can simply initiate the transaction from your POS and then your customer can tap their card or enter their PIN into the mobile terminal at a safe distance. You will see whether the transaction was successful or not on your Point of Sale screen.

- Learn more about integrated solutions here.

- See all POS systems accredited for integration with our EFTPOS solutions.

How do I set this up?

Contact us to find out more about a POS integrated mobile payment solution. A good place to start is to check if your POS is already accredited for integration with our EFTPOS solutions, find out here.

If you don’t currently have a POS system installed, we can provide advice on which options might suit your needs. Our mobile integrated solution is also compatible with contactless ‘paywave’ payments.

I want mobile payments for curbside or home delivery

If you want to take payment in your car park, at the curbside, or at your customer’s workplace or residence, a ‘PayWave’-capable mobile EFTPOS terminal connected to 3G could be right for your business.

How do I set this up?

As an essential service, we have continued to work closely with Courier Post throughout the pandemic. We can arrange a mobile terminal to be delivered by courier anywhere in New Zealand.

Get in touch with us here if you would like more information about mobile EFTPOS terminals. Our team of EFTPOS experts can answer any of your questions and take you through any connectivity and install requirements.

I want to enable contactless ‘PayWave’ payments on my existing payment solution

.png?width=600&height=400&name=T650p_White_BikeShop_Phone_centrapay%20screen%20dec22%20(002).png)

Offering contactless payment acceptance on your device reduces the risk of transmission of COVID-19 via your device’s PIN pad and will provide your customers with greater comfort while paying.

How do I set this up?

If you want to enable contactless payments on your EFTPOS device/s, give the bank that provides your merchant facility a call. See how to contact your bank here.

Need help?

Our customer support teams are available at all COVID-19 Alert Levels.

24/7 Technical Helpdesk:

• Call 0800 EFTPOS (0800 338 767, option 2)

• Submit a support form for non-urgent support requests

Customer Service:

- Call 0800 EFTPOS (0800 338 767, option 3) 8 am - 5 pm, weekdays.

- Email customerservices@eftpos.co.nz

- Submit a contact form

Sales:

If you’re exploring adapting your business in response to COVID-19, we can help. Our team of EFTPOS experts are available to discuss your payment needs:

- Call 0800 EFTPOS (0800 338 767, option 1)

- See other ways to contact sales here

- Get a quote online here

COVID-19 Resources for businesses

- Advice and resources for hospitality businesses

- Advice and resources for retailers

- MBIE guidance on workplace operations at COVID-19 alert levels

- Information for businesses and employees on working safely during COVID-19 and financial support and services available

Disclaimer

The information in this article is intended for guidance only. Accordingly, EFTPOS New Zealand Limited does not accept any liability for any loss or damage, which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained on this site. While every endeavour has been made to supply accurate information, errors and omissions may occur. Click here for our full terms of use.

.jpg)

Comments