New and improved tools and features

New and improved tools and features

Did you know Eftpos NZ has the biggest in-house terminal development team in Australasia? Their job is to keep the smarts that make your EFTPOS terminal work up to date. They also work on updates for your terminal software, and brand-new products and features.

In fact, right now we’re rolling out a new update packed with new features to help you run your business. Read on for some of the highlights.

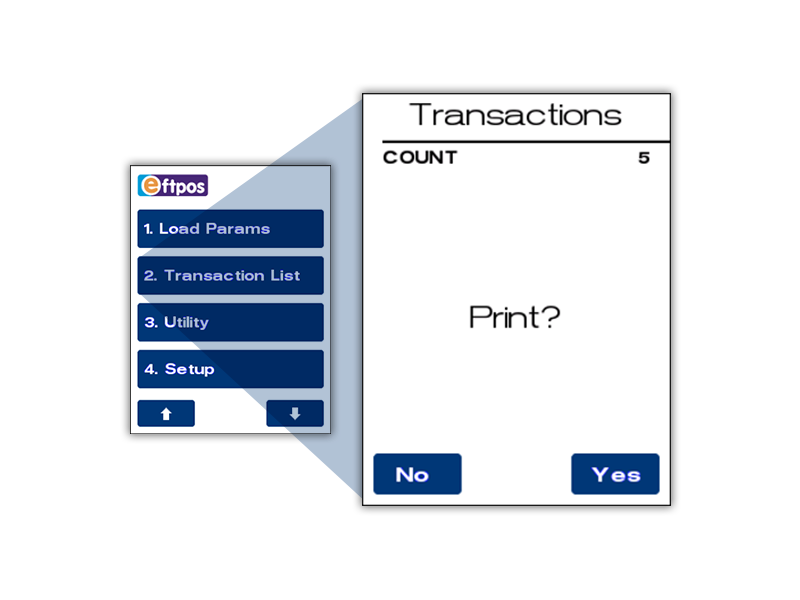

Daily transaction reporting at your fingertips

Now you can print a full day's transaction listing from any of the past 14 days. See all completed or current transactions for each terminal without performing a cutover or requesting a transaction listing from us. Check in on how much you've put through the terminal that day, or get the details for a particular transaction quickly and easily. Learn more about transaction reporting.

Coming soon: Improvements to CPC currency conversion

If you have Customer Preferred Currency on your terminal, you'll soon notice some changes to your solution. We’ve simplified the preferred currency offer screen so only your customers home currency and NZD are shown, which means more opt-ins and potentially a higher merchant rebate. We’ve also expanded the range of terminals CPC is available on to include our two-piece and even our POS integrated solutions.

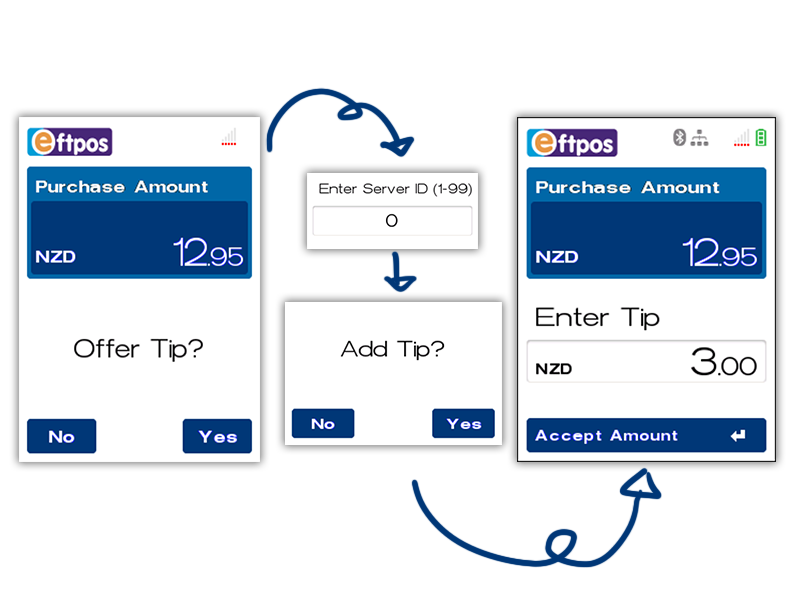

Enhancements to our tipping solution

Great service deserves reward! With our new server ID and reporting features, you can fairly allocate all tips to the correct team members. Your staff simply enter their unique ID number after selecting ‘Yes’ on the Offer Tip screen. That way each tip is associated with the staff member who earned it.

The new accumulated tip reporting feature allows you to view tip totals by team member and a full summary of all your tips. Learn more about our tipping solution here.

Enhancements to our pre-authorisation solution

A credit card pre-authorisation is when you put a temporary "hold" on funds on your customer’s card and then complete the transaction once the service is completed or goods exchanged. Pre-authorisations can vastly reduce missed revenue, fraud, and processing costs. Using a pre-auth solution can also help your customers manage their costs and makes settling the bill easier.

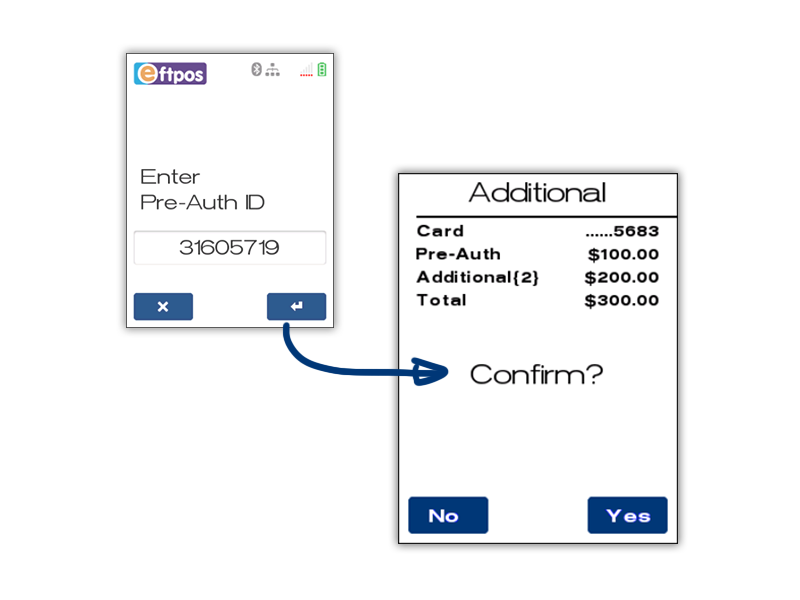

We’ve now added three new features to our pre-authorisation solution:

1. Additional Pre-auths

Additional pre-authorisations allow you to increase the value of an open pre-auth to cover additional costs incurred

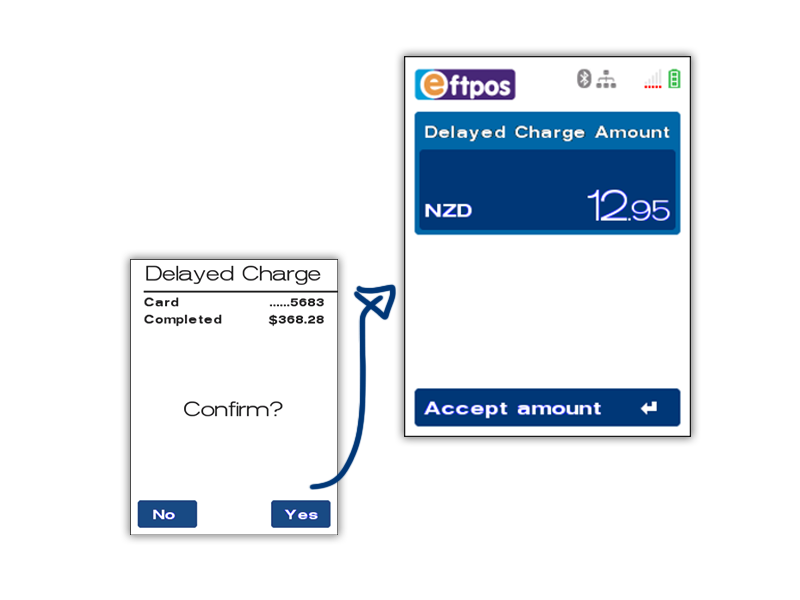

2. Delayed Charges

Delayed charges allow you to process payments against a pre-auth, even after you’ve completed the pre-auth and your customer has left

3. Reporting

New reporting features allow staff to easily find misplaced pre-auth numbers

How businesses use pre-auths

Pre-authorisation and completion transactions are great for any business that offers their service in advance of payment.

For example, a dress-making shop might want to take a ‘deposit’ in the form of a pre-auth, which can then be increased using additional pre-auths if additional materials or hours are required to meet the customer’s needs.

Accommodation businesses can use a pre-auth to hold funds to cover their guest’s planned stay. They can add to it using additional pre-auths if their guests decide to get a massage, or order room service. With delayed charges, accommodation businesses can offer the convenience of an express check-out booth where guests simply deposit their room key, without risking lost revenue if the guest has used the mini bar.

................

CPC currency conversion is only available to ANZ merchants with an EFTPOS NZ terminal on the Verifone network. Standard Pre-Auth & Completion functionality, including open pre-auth reporting, is available to any merchant using an EFTPOS NZ terminal on the Verifone network at no additional charge. Delayed charges and Additional Pre-Auths are now available to EFTPOS NZ customers on the Verifone network for just $9.95 + GST per terminal, per month.

Want to know more? Give us a call on 0800 EFTPOS (option 3) — we’d love to hear from you.

Comments