3. Eliminating the Risk of Theft

Ever seen a retail store displaying signs that boldly proclaim, "No cash kept on premises" to deter would-be thieves? Well, the alarming truth is that retail crime is on the rise, as reported by the Retail Crime Report 2023 from Retail NZ.

Cashless payments allow you to keep your hard-earned profits safe from smash-and-grab robberies.

By embracing the convenience of cashless payments, not only do you create a safer environment for both yourself and your valued customers, but this becomes particularly crucial if your business operates in a neighbourhood known for its high rates of thefts and robberies.

4. You can do more with EFTPOS payments

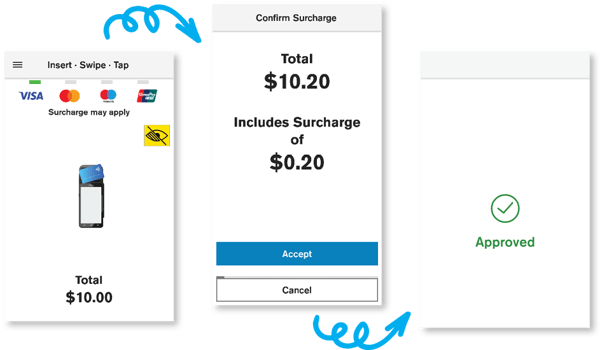

Surcharging

As a business owner, it is important to prioritise offering a seamless payment experience to your customers. However, it's worth considering that some payment options come with associated costs, such as credit cards and contactless cards.

Fortunately, surcharging offers a solution that allows you to provide these convenient payment options to your customers while offsetting the costs to your business.

Your EFTPOS terminal will automatically identify transactions that contribute to your Merchant Service Fees and pass on the cost to your customer through a surcharge. This way, you can ensure that your business remains profitable while still providing the payment options your customers prefer.

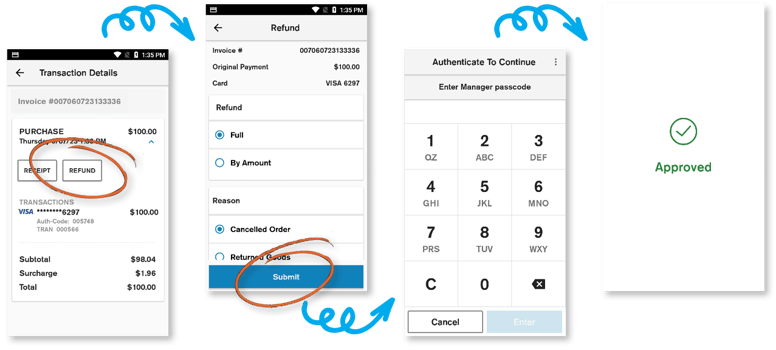

Refunds

From time-to-time, you might need to issue a customer with a refund. Using EFTPOS can make refunds more secure and traceable in your business.

Our Android EFTPOS solutions make processing a refund super easy. Your customer can simply tap the card they used to make the original purchase to bring up a list of all transactions processed using their card from the last 3 months. From there you can view the transaction details, reprint/resend the receipt, or start the refund.

For extra security, a passcode is required to process a refund. You can even set different refunds limits for managers and cashiers, so that higher value refunds need to be approved by a manager.

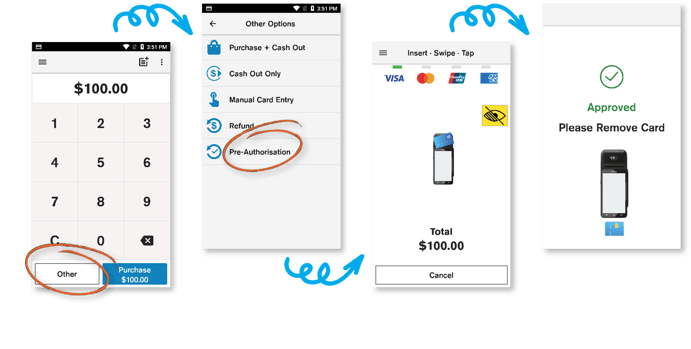

Pre-authorisations

Pre-authorisations reduce the risk of fraud and theft significantly for businesses that offer service before payment.

Pre-authorisations reduce the risk of fraud and theft significantly for businesses that offer service before payment.

Not only this, but you can also process a delayed charge against a completed pre-authorisation. This will ensure that your customers pay for all the service they receive - even after they have left.

The best part is, they only need to present their card once. If additional costs are incurred after the initial pre-authorisation, there's no need to present the card again.

.gif?width=600&height=288&name=Verifone%20Central%20Login%20(2).gif)

Comments