From new regulations around surcharging and lower processing fees, to industry shake-ups and cutting-edge innovations, these trending topics in the payments industry could have a big impact on your business.

1. Regulation of Surcharging

More businesses are adding surcharges to offset the costs of contactless and credit card payments, but big changes could be on the way. In Australia, the government plans to ban debit card surcharges and is also looking at capping credit card surcharges to ensure fairer practices. New Zealand is likely to follow suit, with the Commerce Commission already signaling its expectations: surcharges should stay within 0.7% for contactless debit payments and 1.5–2% for credit card transactions. Surcharges over 2% are potentially on the chopping block. For businesses, this is a good time to review your surcharge practices and get ahead of the curve.

2. Lower Interchange Fees

Interchange fees—the charges you pay for processing card payments—can eat into your profits. Regulators are looking to make these fees fairer, especially for small businesses. If the rules change, you could see lower costs, making it easier to offer contactless and credit payment options without worrying about losing too much of your margin. Check out our article on the Commerce Commissions plans for Interchange Fees here.

3. BNPL: A Modern Twist on Credit

"Buy Now, Pay Later" (BNPL) services like Afterpay let customers split payments into smaller, interest-free instalments. This has become hugely popular, especially with younger shoppers who like flexibility. For your business, BNPL can mean more sales and happier customers. Whether you run a store or sell online, it’s worth exploring BNPL options to stay competitive.

4. Cryptos and CBDCs: What’s Next for Digital Money?

Cryptocurrencies like Bitcoin and central bank digital currencies (CBDCs) are becoming more mainstream. While the idea of accepting crypto payments might seem futuristic, it’s worth keeping an eye on this trend. Governments are testing CBDCs, and as these tools evolve, they could provide secure, regulated ways to expand your payment options in the future. Android EFTPOS customers can already accept cryptocurrencies thanks to our integration with Centrapay.

5. Diversifying Providers

Payment providers are shaking things up. Companies that traditionally focused on offering EFTPOS devices are now venturing into online payment solutions, while banks are expanding their range of payment products. Some terminal providers are even stepping into merchant services and acquiring—areas traditionally dominated by banks. This shift creates both opportunities and risks for businesses, particularly new players in the merchant services space that may lack the expertise required to manage these complex services effectively.

6. Further Shift to eCommerce

Expanding use cases in the eCommerce space are creating new opportunities to streamline payments and enhance customer convenience:

-

Customer-Initiated Transactions (CIT): These are payments triggered directly by the customer, such as online purchases or bill payments,. For example, when a customer pays their power bill online or buys a product on your website, that’s a CIT. CITs also allow for storing payment details for future use, making repeat transactions faster and easier.

-

Merchant-Initiated Transactions (MIT): These occur without the customer being directly involved at the time of payment, typically as part of a pre-approved agreement. Examples include subscription renewals, installment payments, or scheduled billing where the initial transaction was captured via a secure online checkout. If your business offers monthly memberships or subscription boxes, MITs allow you to charge customers automatically without requiring them to take action every time.

Interested in what Verifone Online Payments can do for your business? Contact us here.

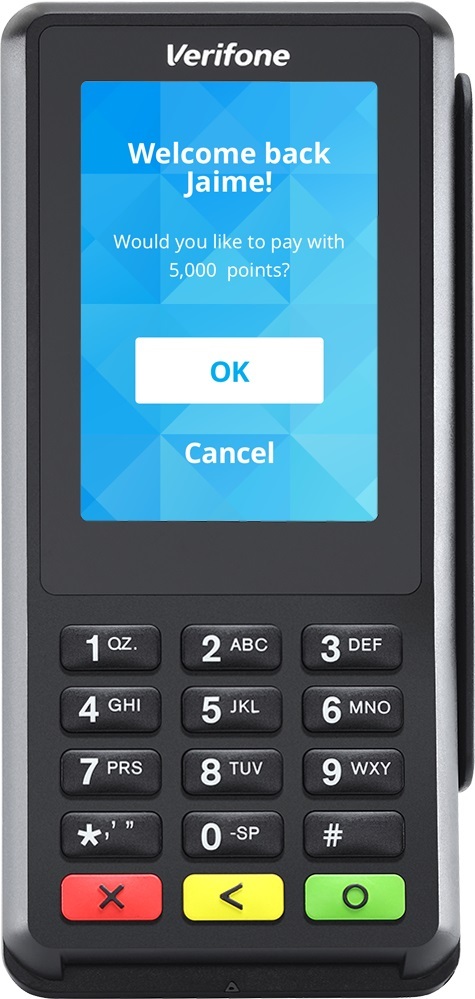

7. Loyalty on Device

Imagine rewarding customers instantly at checkout without needing separate loyalty cards or apps. That’s the vision behind loyalty-on-device programs, soon to be possible with Android-based payment terminals.

Whether it’s offering discounts, loyalty points, or cashback at the point of purchase, this technology could be a game-changer for small businesses looking to build stronger customer relationships. While loyalty-on-device isn’t available yet, it’s worth keeping an eye on this emerging trend.

Stay ahead of payment trends and get insights delivered straight to your inbox. Sign up for the Eftpos NZ quarterly email newsletter here.

Comments